What is Fiscal First Aid?

By:

Mike Mucha, GFOA Deputy Executive Director

Shayne Kavanagh, GFOA Senior Manager of Research

Katie Ludwig, GFOA Senior Manager

Jamie Porter, GFOA Program Associate

COVID-19 and the associated recession has presented immediate financial difficulties and has also harmed the long-term financial outlook for local governments.

To help local governments deal with the many short-term and long-term challenges, the GFOA has a program called Fiscal First Aid. Fiscal First Aid is the process of recognizing, arresting, and reversing a pattern of financial decline. Fiscal First Aid was originally created more than ten years ago to help local governments deal with the 2008 Great Recession. We have completely updated and revised it for 2020.

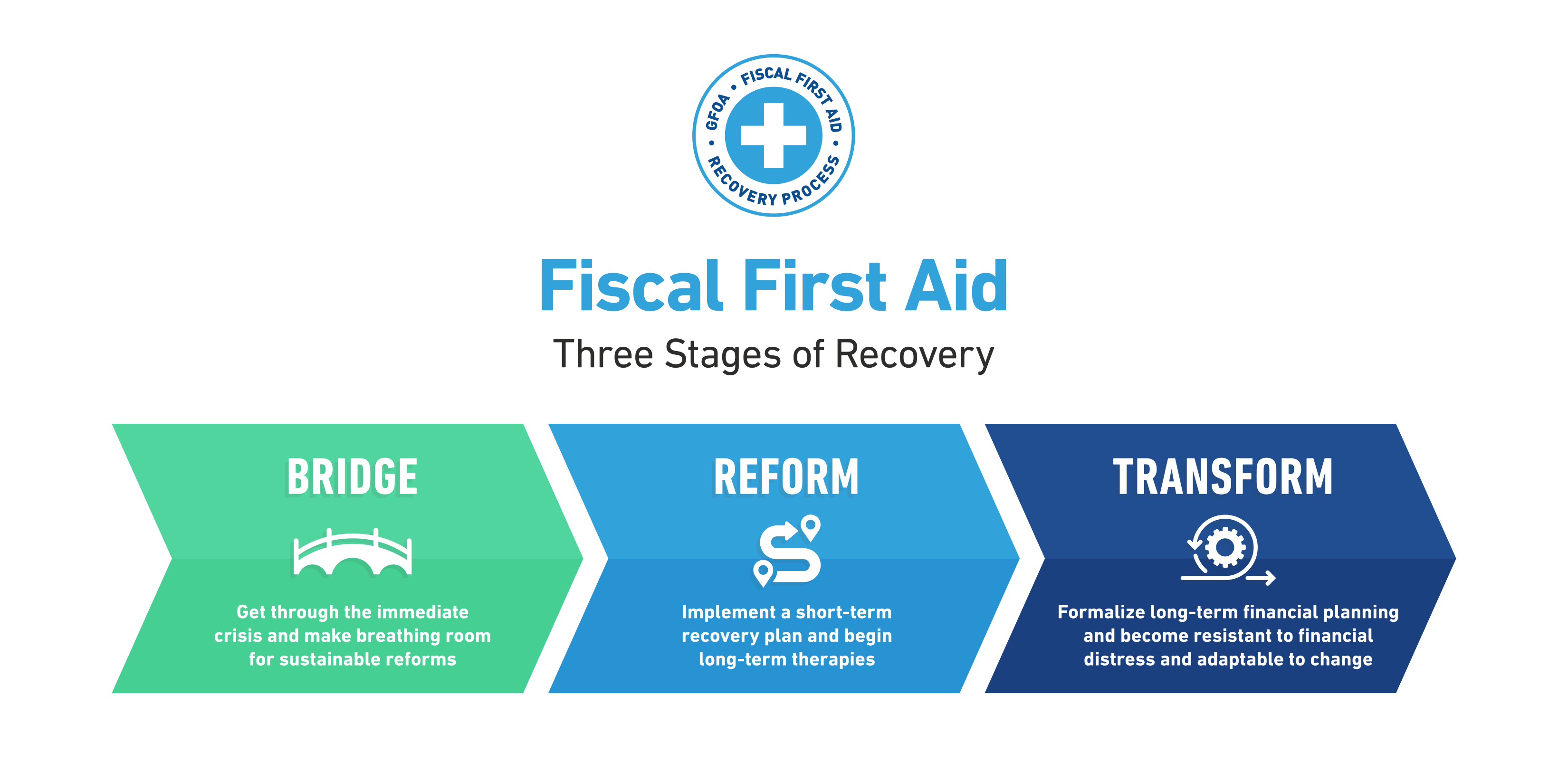

At the core of Fiscal First Aid is its Three Stages of Recovery. We have summarized the three stages below and provided links to some of the most essential resources at our Fiscal First Aid website (gfoa.org/ffa).

#1 Bridge. In the Bridging Stage, the government must get through and avert the immediate crisis and create breathing room to make more sustainable reforms. Bridge includes:

Forming a team to lead the recovery. The finance officer can’t do it alone. Help will be needed. Ask yourself: what other roles are needed? For example, human resources expertise is necessary if strategies like layoffs or furloughs are on the table. Communications expertise will be needed as well. Recovery is an uncertain time and if the recovery team does not share enough information, rumors may fill the void. Of course, cost reductions will have impacts on services, so operations expertise will be needed to help mitigate the impact. Consider what roles might be most important for your recovery and recruit the right people to join the team.

Slowing the flow of money out the door with basic cut-cutting techniques that can be deployed quickly. The GFOA has a multitude of tried and true retrenchment techniques that can improve cash flow during difficult times. Three examples include first, instituting a short-term hiring freeze which may provide some immediate financial relief. Second, reducing the scope of capital projects to trim inessential features. Ideally, this would produce a more favorable balance between cash inflows and outflows. And third, finding areas of the budget that regularly generate surpluses and directing excess resources elsewhere.

Implementing a Cash Flow Forecast to get forewarning of potential cash flow difficulties. The GFOA has a cash flow forecasting model that analyzes the net impact of major revenues, expenditures, and corresponding balances projected over a 36-month period. This tool is free for GFOA members and is a great way to showcase that finance has a handle on the situation at hand.

#2 Reform. In the Reform Stage, the government carries out the short-term recovery plan and develops and implements short and long-term strategies to balancing the budget without making things worse in the long run in the Reform Stage. Reform includes:

Diagnosing your causes of financial distress. Diagnosis must come before treatment. This diagnosis will work best if it is guided by a model that helps you think about financial health. GFOA’s diagnostic model asks you to consider critical questions: financial position & parameters, budget practices, liabilities, and the political and economic environment. The answers to these questions will suggest treatments that you could apply.

Applying low-risk treatments. Some budget balancing techniques have little risk of adverse side effects. An example of an adverse side effect would be increasing your long-term costs, as would be the case with deferring maintenance on critical infrastructure. Treatments without such side effects should be your first choice.

Explore ideas for bigger reform. A financial crisis may spur people to consider new ways of operating that they would not have considered before. In some cases, new ways of operating might be necessary if the government is to make a full recovery, rather than just emerge from current crisis only to experience persistent, but lower-grade financial stress for years into the future. Examples of further reaching reform could include: controlling employee benefit costs; moving away from incremental budgeting systems that layer new costs on top of the old; ensuring capital assets are affordable now and in the long-run; and improving or simplifying work processes.

#3 Transform. In the Transform Stage, the government aims to come back better, stronger, and more resilient than before. The first step is implementing ideas for bigger reform that were explored in the Reform Stage. However, transformation also means transforming the decision system for better responses to future potential financial difficulty. GFOA’s Financial Foundations for Thriving Communities describes both the leadership strategies and the institutional designs principles local governments need. It describes how to build the trust and open communication necessary for people to make good decisions, together. It also describes how to set the “rules of the road” that support good decision-making and ensure the continuity of good financial practices through changes in leadership.

Where should you go from here?

Visit www.gfoa.org/ffa to get access the following:

- A breakdown of the 3 stages of recovery in to a more detailed 12-step process.

- Diagnostic model. A full, ready-to-use diagnostic model is available to help find causes of financial distress that you can address

- Catalog of budget balancing techniques. The site highlights the most and least recommended techniques for providing short-term relief for financial distress.

- Catalog of long-term treatments. A number of strategies to improve financial condition over the long term are discussed.